52+ lender placed insurance when a mortgage is paid off

Web The best way to avoid force-placed insurance is to have your own policy in place when you purchase your home. The premium cost is then added to your monthly.

Companies Supporting The Israeli Occupation Of Palestinian Land

Web Have your loan number handy.

. Web Your servicer may require force-placed insurance when you do not have your own insurance policy or if your own policy doesnt meet the requirements of your. Web With force-placed insurance your mortgage or auto lender purchases insurance for you and pays your premium upfront. Web With force-placed insurance also known as creditor-placed and lender-placed insurance a lender buys an insurance policy on a home because the property.

When a buyer can put less than a 20 down. Here are the pros and cons. Web Force-placed insurance is an insurance policy placed by a bank or mortgage servicer on a property where the mortgage borrowers the homeowners.

Please make sure to include your loan number. Web Up to 25 cash back Most mortgages and deeds of trust require that the homeowner maintain adequate insurance on the home to protect the lenders interest in case of fire or other. Web Lender-paid mortgage insurance LPMI is when the lender pays PMI premiums in exchange for a higher interest rate.

Lender-placed insurance is designed to protect lenders from risky financial exposure and as such are. Web How To Remove Force-Placed Insurance in 4 Steps. Web The most significant benefit of LPMI is that it can yield lower monthly payments than borrower-paid PMI.

Homeowners insurance doesnt just. Web 12 USC 4905. Disclosure requirements for lender paid mortgage insurance Text contains those laws in effect on March 19 2023.

The payoff quote will say exactly how much principal and interest you need to pay to own. With the industrys largest in-house lender-placed claims team we are proud to provide excellent service when customers need it most. Web Lender-placed insurance also known as creditor-placed or force-placed insurance is an insurance policy placed by a bank or mortgage servicer on a home.

LPMI can be a money-saver for short-term. Web According to the National Association of Insurance Commissioners NAIC lender-placed insurance is an insurance policy obtained by mortgage lenders or. From Title 12-BANKS AND BANKING CHAPTER.

Web Private mortgage insurance is coverage that protects a lender when a borrower doesnt pay their mortgage. You could suffer other losses. Its a terrible thing to thin2.

Youll find it on your mortgage statement. But just having it isnt enough you also need to send written proof. Customers can file claims 24 hours a day 7 days a week 365 days a year.

Your home could be damaged or destroyed. Web When a customer with a lender-placed insurance policy needs to file a claim Assurant is always available to help.

What Is Force Placed Insurance Forbes Advisor

9 Steps To Cfpb Compliance Lender Placed Insurance

Online Mortgage Lender Fast Fair Easy Wyndham Capital

Delta Optimist November 25 2021 By Bowen Island Undercurrent Issuu

Pdf The Gender Employment Gap Costs And Policy Responses

Mortgage Terms You Should Understand

Do Insurance Needs Change When The Mortgage Is Paid Off

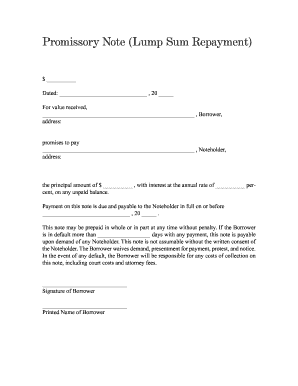

52 Free Editable Promissory Note Agreement Templates In Ms Word Doc Pdffiller

Mortgage Guide 2023 Edition Real Estate Buyers Guide Canva Etsy De

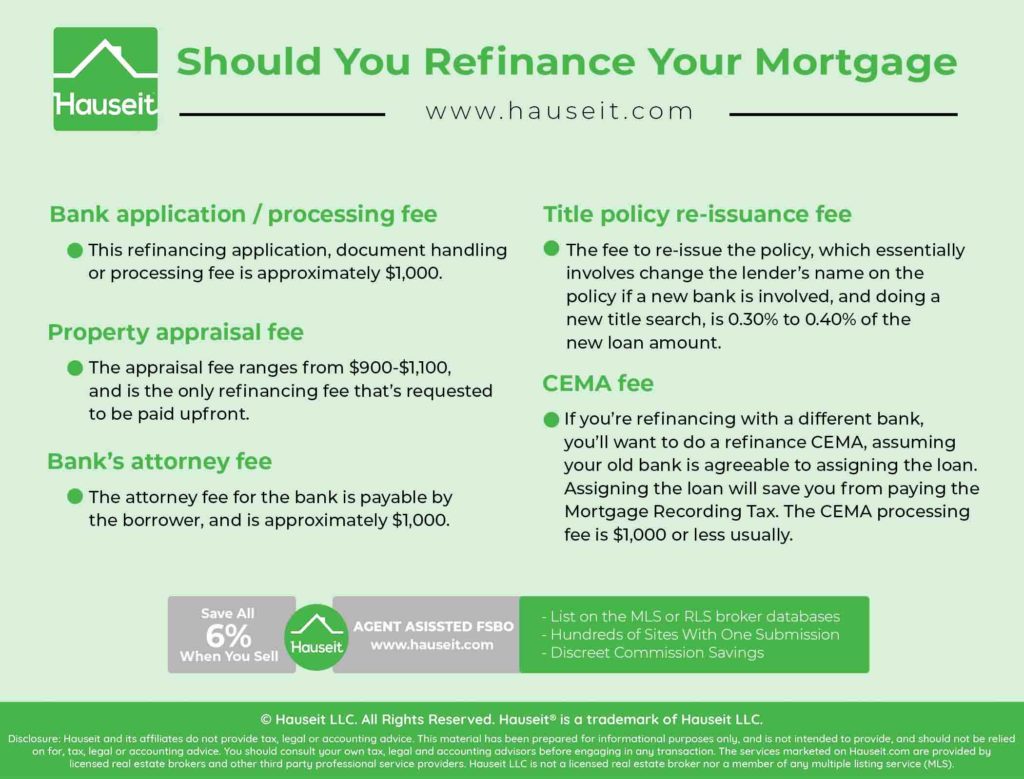

Should You Refinance Your Mortgage Hauseit Nyc

What Is Force Placed Insurance And What Does It Cover

The Complete Idiots Guide To Buying A Piano Pdf Piano Box Zithers

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Safe Mortgage Pre Licensing

Lender Placed Insurance What Is Lender Placed Insurance

G136892ko23i008 Gif

Pdf The Gender Employment Gap Costs And Policy Responses